Post Office PPF Calculator 2026: A Practical Guide to Interest, Contributions, and Maturity ValueFor individuals looking for a reliable and stress-free way to build long-term savings, the Public Provident Fund (PPF) continues to be one of the most trusted options in India. Backed by the government and designed for disciplined wealth creation, PPF suits investors who value safety, tax efficiency, and predictable growth. As 2026 approaches, a Post Office PPF calculator helps transform this traditional savings scheme into a clear financial roadmap by showing how regular investments can grow over time.

Rather than relying on assumptions, the calculator allows investors to see realistic outcomes based on contribution patterns, tenure, and interest rates.

How the PPF Interest Rate Works in 2026

The PPF interest rate is reviewed and announced by the government every quarter. Based on recent trends, the rate for 2026 is expected to remain around 7.1% per annum, compounded yearly. While this return may not appear aggressive when compared to market-linked investments, its real value lies in consistency and sovereign backing.

This steady compounding ensures that savings grow quietly without exposure to market volatility. For conservative investors and long-term planners, this predictability often outweighs higher but uncertain returns elsewhere.

Key Details of Post Office PPF in One Place

| Feature | Information |

|---|---|

| Scheme Name | Public Provident Fund (PPF) |

| Availability | Post Offices & Authorized Banks |

| Expected Interest Rate (2026) | ~7.1% per annum (compounded annually) |

| Minimum Yearly Investment | ₹500 |

| Maximum Yearly Investment | ₹1.5 lakh |

| Lock-in Period | 15 years |

| Extension Option | In blocks of 5 years |

| Tax Benefit | EEE (Investment, Interest & Maturity tax-free) |

| Risk Level | Very Low (Government backed) |

| Loan Facility | From 3rd to 6th year |

| Partial Withdrawal | Allowed from 7th year |

| Premature Closure | Only under specific conditions |

Flexible Contribution Options for Different Income Levels

One of the strongest features of the PPF is its flexibility. Investors can contribute any amount between ₹500 and ₹1.5 lakh in a financial year, depending on their capacity. Contributions can be made in a lump sum or spread across monthly or quarterly deposits.

A PPF calculator becomes especially useful here, as it allows you to compare different investment styles. For example, you can see how a monthly contribution compares to a single annual deposit and choose what suits your cash flow without financial pressure.

Understanding the 15-Year Maturity Value

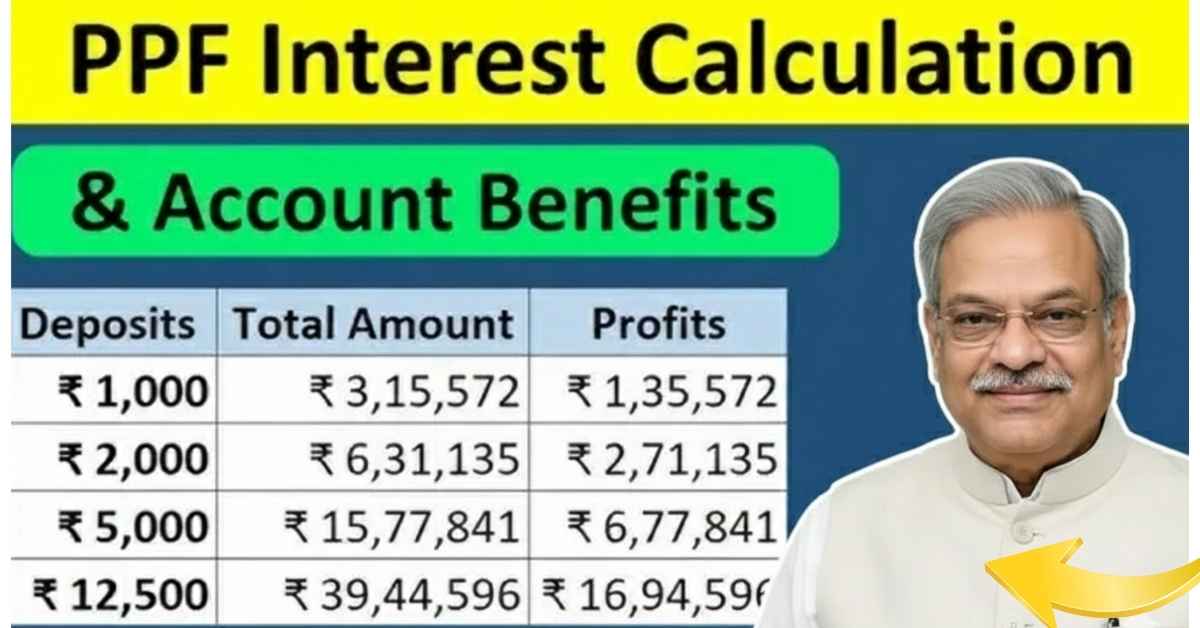

PPF comes with a fixed tenure of 15 years, which encourages long-term discipline. The final maturity amount depends on three main factors: how much you invest each year, the interest rate, and the duration of compounding.

For instance, consistently investing the maximum limit over the full tenure can result in a substantial corpus by maturity. A calculator clearly shows how even small increases in yearly investment or early contributions can significantly impact the final amount. This clarity helps align PPF savings with long-term goals such as retirement planning, children’s education, or financial security.

Why PPF’s Tax Benefits Matter

PPF enjoys the rare Exempt-Exempt-Exempt (EEE) status under Indian tax laws. This means your yearly investment qualifies for deduction under Section 80C, the interest earned every year is tax-free, and the final maturity amount is also exempt from tax.

This triple tax advantage greatly improves the effective return, making PPF one of the most tax-efficient long-term savings instruments available.

Role of PPF in Long-Term Financial Planning

PPF is often considered a foundation investment rather than a standalone solution. Its guaranteed returns and tax efficiency make it ideal for retirement planning and capital preservation. The long lock-in period encourages disciplined saving, which many investors struggle to maintain in flexible instruments.

By using a PPF calculator regularly, investors can track progress and decide whether they need additional investments to meet future goals comfortably.

Making the Most of Your Contributions

Timing plays an important role in maximizing PPF returns. Depositing your contribution before the 5th of April each year ensures that the amount earns interest for the full financial year. A calculator highlights how early deposits benefit long-term compounding compared to delayed investments.

Over a 15-year period, this small habit can make a noticeable difference in the final corpus.

Frequently Asked Questions (FAQ)

1. Can NRIs open a new PPF account in 2026?

No. NRIs are not allowed to open new PPF accounts. Existing accounts opened before becoming an NRI can continue till maturity.

2. What happens if I miss the minimum yearly contribution?

If ₹500 is not deposited in a year, the account becomes inactive. It can be reactivated by paying a penalty and pending minimum contributions.

3. How is PPF interest calculated?

Interest is calculated on the lowest balance between the 5th and the last day of each month and credited annually.

4. Can I change my investment amount every year?

Yes. You can invest any amount within the allowed range each financial year, depending on your situation.

5. What options are available after PPF maturity?

You can withdraw the full amount, extend the account with contributions, or extend it without making further deposits.

6. Is the PPF interest rate guaranteed for 15 years?

No. The rate is reviewed quarterly. However, it has historically remained stable compared to market-linked products.

Final Takeaway

In 2026, the Post Office PPF continues to stand as a symbol of safe and disciplined investing. While it may not deliver rapid growth, it offers something equally important—financial certainty. By using a PPF calculator to plan contributions and understand future returns, investors can confidently build a stable financial future based on patience, consistency, and trust