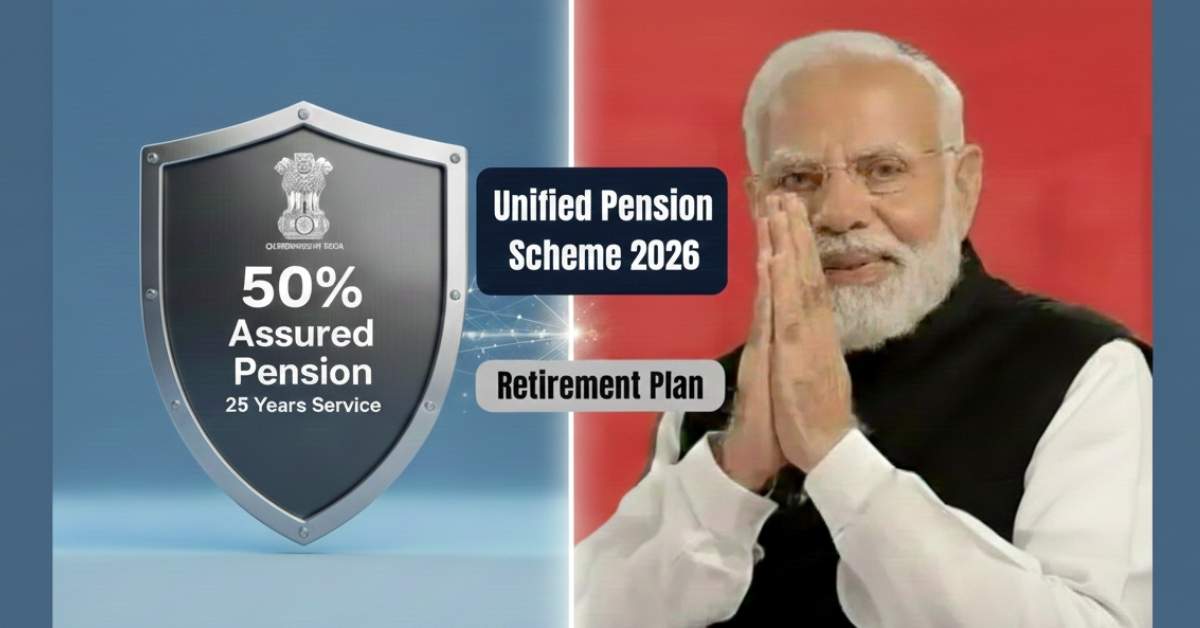

Unified Pension Scheme 2026: The Unified Pension Scheme (UPS) 2026 marks a significant step in reshaping how retirement benefits are managed for government employees in India. Rather than introducing yet another complex rulebook, the scheme focuses on simplifying existing pension structures while ensuring long-term financial stability for those who dedicate their careers to public service. At its core, the policy seeks to balance administrative clarity with dignity and predictability in retirement.

As discussions around pension reforms grow louder, the UPS 2026 has drawn attention for its emphasis on transparency, fair treatment, and flexibility—particularly for employees considering early retirement.

Bringing Order to a Complicated Pension Landscape

For many years, pension rules for government employees varied across departments and states. Different contribution structures, calculation formulas, and administrative processes often created uncertainty, especially for employees nearing retirement. The Unified Pension Scheme aims to reduce this fragmentation by bringing multiple pension-related rules under a single, coordinated framework.

This consolidation does not merely simplify paperwork. It allows employees to better understand their future benefits, make informed career decisions, and plan retirement without relying on assumptions or informal interpretations of rules.

How the New Framework Improves Retirement Security

The updated scheme focuses on strengthening the foundation of retirement income. One of its central ideas is ensuring that every eligible retiree receives a reasonable and predictable pension amount. By improving government contributions and streamlining fund management, the scheme works toward making pension payouts more stable over time.

Another important element is protection against rising living costs. While pensions were traditionally static in nature, the UPS 2026 introduces structured mechanisms to review and adjust benefits periodically. This helps protect retirees from the gradual loss of purchasing power caused by inflation.

A Fairer Approach to Early Retirement

Early or voluntary retirement has historically been a difficult choice for government employees. In the past, opting to leave service before the standard retirement age often resulted in a sharply reduced pension, making the option financially unattractive. The Unified Pension Scheme 2026 addresses this concern by revising how early retirement pensions are calculated.

Instead of heavy penalties, the revised method gives greater weight to total years of service and final salary levels. This ensures that employees who choose early retirement still receive a meaningful pension, reflecting their contribution over the years. As a result, individuals gain more flexibility to explore second careers, focus on health, or pursue personal goals without compromising basic financial security.

Key Information About Unified Pension Scheme 2026

| Feature | Details |

|---|---|

| Scheme Name | Unified Pension Scheme (UPS) 2026 |

| Implementing Authority | Government of India with State Governments |

| Target Group | Central & State Government Employees |

| Core Objective | Simplify pension rules and ensure retirement security |

| Minimum Pension | Revised baseline for dignified living |

| Early Retirement | Fairer pension calculation for voluntary exit |

| Inflation Adjustment | Periodic review mechanism included |

| Administration | Centralized and transparent system |

| Coverage | Serving, future, and existing pensioners |

Wider Impact on Government Employees

The effects of the Unified Pension Scheme extend across different stages of employment. Employees close to retirement gain clarity on expected benefits, reducing anxiety during their final years of service. Mid-career professionals benefit from flexibility, as early retirement becomes a realistic option rather than a financial risk.

For new entrants, the scheme improves the attractiveness of government service by offering a clear and dependable retirement promise. Even existing pensioners stand to benefit from improved administrative efficiency, quicker grievance resolution, and better access to information.

Looking Ahead: More Than a Policy Change

The Unified Pension Scheme 2026 is not just about revising numbers or merging rules. It reflects a broader shift toward acknowledging the long-term contribution of public servants. By reducing complexity, improving fairness, and adding flexibility, the scheme aims to create a retirement system that aligns with modern economic realities.

While exact pension outcomes will still depend on individual service records and pay scales, the overall structure signals a stronger commitment to security, respect, and peace of mind after retirement.

Frequently Asked Questions (FAQ)

1. Who is covered under the Unified Pension Scheme 2026?

The scheme applies to central and state government employees, including serving staff, future recruits, and existing pensioners under earlier systems.

2. Does the scheme support early or voluntary retirement?

Yes. The UPS 2026 introduces a more balanced pension calculation for early retirement, reducing harsh penalties seen in earlier systems.

3. How is inflation addressed in the new pension structure?

The scheme includes periodic review mechanisms to adjust pension payouts, helping maintain their real value over time.

4. Will old pensioners need to reapply under the new scheme?

Administrative processes are unified, but core pension entitlements remain linked to the rules applicable during their service period.

5. Where can employees find official and detailed guidelines?

Employees should refer to notifications issued by the Department of Pension & Pensioners’ Welfare (DoPPW) and relevant state finance departments for authoritative details.